XRP Price Prediction: Navigating Technical Support and Regulatory Tailwinds

#XRP

- Technical Positioning: XRP trades below key moving averages but above crucial Bollinger Band support at $2.7661

- Regulatory Catalyst: UK-US crypto task force formation could provide regulatory clarity benefiting XRP

- Network Strength: Record high active addresses signal strong fundamental usage despite price weakness

XRP Price Prediction

XRP Technical Analysis: Key Levels to Watch

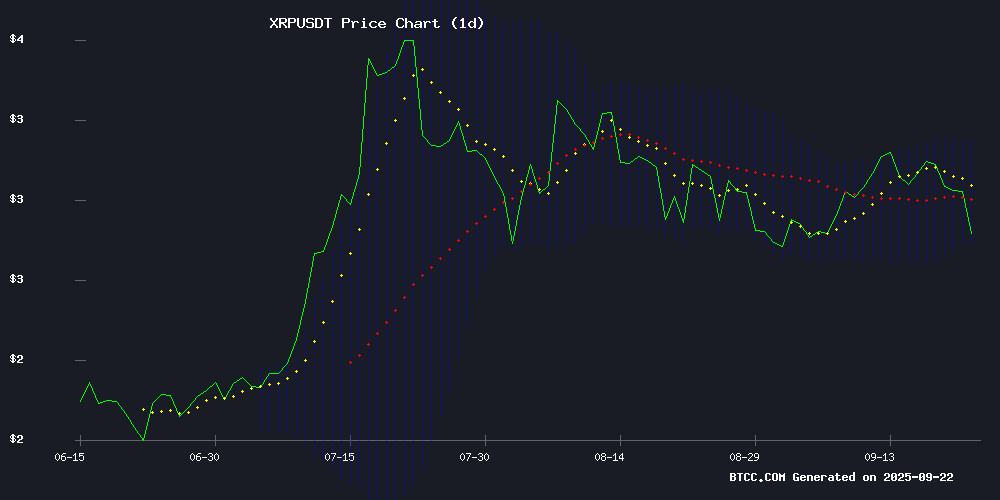

XRP is currently trading at $2.8473, below its 20-day moving average of $2.9654, indicating short-term bearish pressure. The MACD reading of -0.1005 suggests weakening momentum, though the histogram shows some stabilization at -0.0137. Bollinger Bands place immediate resistance at $3.1647 and support at $2.7661, with the middle band at $2.9654 acting as a crucial pivot point.

According to BTCC financial analyst Olivia, 'The current technical setup shows XRP testing key support levels. A break below $2.7661 could trigger further declines, while reclaiming the 20-day MA around $2.96 WOULD signal renewed bullish momentum.'

Mixed Sentiment Surrounds XRP Amid Regulatory Developments

XRP faces conflicting market signals with record-high active addresses on the XRP Ledger contrasting with price declines. Positive developments include Axelar's mXRP perpetual buyer mechanism and regulatory clarity from the UK-US crypto task force, while bearish pressures stem from technical indicator warnings and broader market pullbacks.

BTCC financial analyst Olivia notes, 'The fundamental landscape for XRP shows both innovation and challenges. The record network activity is bullish long-term, but short-term price action remains constrained by technical resistance and market-wide risk aversion despite recent Fed rate cuts.'

Factors Influencing XRP's Price

XRP Yield Innovation or Risk? Midas & Interop Labs Face Mixed Response

Partners within the Ripple ecosystem have introduced mXRP, a yield-bearing product for XRP Ledger's native token, sparking divergent reactions from the community. Developed by Interop Labs in collaboration with Midas, the product leverages Axelar's interoperability network to offer tokenized exposure with potential returns up to 10% APY.

The initiative, unveiled at XRP Seoul 2025, targets dormant XRP supply by enabling holders to mint mXRP through collateral deposits. Despite its promise to bridge DeFi opportunities, skepticism lingers over risks associated with smart contract audits and centralized structuring by Midas.

Axelar Unveils mXRP as Perpetual Buyer Mechanism for XRP, Sparking DeFi Hype

Axelar's presentation at XRP Seoul 2025 introduced mXRP, a yield-bearing token framed as an "infinite money glitch" for the XRP ecosystem. The mechanism creates a closed-loop system where minting mXRP programmatically purchases XRP, auto-compounds yields, and deepens XRPL liquidity—potentially attracting institutional capital.

EU-regulated tokenization platform Midas powers the product, which promises 10% APY for mXRP holders. Anodos Labs CEO Panos Mekras called it "the biggest catalyst this quarter" for XRP adoption, highlighting how yield-bearing derivatives could accelerate DeFi integration on the XRP Ledger.

XRP Ledger Active Addresses Hit Record High Amid Price Decline

The XRP Ledger has achieved a significant milestone as active addresses surge to an all-time high, even as the cryptocurrency's price struggles to regain momentum. Data from XRPScan reveals over 7 million accounts now maintain the minimum 1 XRP balance required for activation—a network record.

Validator VET suggests the term 'activated accounts' more accurately reflects this metric, though XRPScan notes approximately 7.7 million accounts have ever been activated. Daily active address counts tell a different story, with Santiment reporting 38,471 on September 21—far below June's peak activity levels.

'On-chain is the new online,' declared Vet in a bullish assessment of the ledger's growth. The divergence between network adoption and price action presents a curious case study in cryptocurrency valuation dynamics.

UK and US Form Crypto Task Force to Shape Global Digital Assets Rules

The United Kingdom and the United States have launched a joint initiative, the Transatlantic Taskforce for Markets of the Future, to align regulatory approaches for digital assets and capital markets. Announced during President Donald Trump's state visit to the UK, the collaboration signals a strategic push to harmonize oversight between the two financial powerhouses.

The task force will prioritize short-term coordination while developing long-term frameworks for wholesale digital market innovation. High-level discussions between UK Chancellor Rachel Reeves and US Treasury Secretary Scott Bessent included participation from major crypto firms like Coinbase, Circle, and Ripple, alongside traditional financial institutions such as Citi and Bank of America.

This transatlantic partnership underscores growing institutional recognition of digital assets' role in global finance. The involvement of both crypto-native companies and legacy banks suggests a convergence of traditional and decentralized finance paradigms.

This Key Ripple (XRP) Indicator Drops to a 3-Month Low: Price Rebound on the Way?

XRP's recent correction may soon reverse, according to a critical market metric. The Relative Strength Index (RSI) plunged below 20 for the first time since June 22, signaling potential oversold conditions. Historically, RSI levels below 30 precede bullish reversals.

The token briefly dipped to $2.78 before recovering to $2.85, reflecting a 5% daily decline. Despite the drop, analysts maintain bullish forecasts, with some predicting new all-time highs. Market capitalization temporarily fell below $170 billion, ceding third place to Tether's USDT.

Traders monitor RSI as a key momentum indicator. Current readings suggest accumulating pressure for an upward move. The XRP community remains steadfast, with prominent voices like John Squire reinforcing long-term confidence in the asset.

XRP Faces Bearish Pressure as Technical Indicators Signal Downtrend

XRP's market trajectory has turned negative, with technical analysis pointing to potential further declines. The token's MACD indicator recently formed a bearish crossover—the first since September 8—suggesting weakening momentum and growing selling pressure.

TradingView charts show XRP has breached its 20-day exponential moving average, now hovering around $2.97. This technical breakdown typically prompts traders to reduce positions, potentially accelerating downward movement toward two-month lows.

The shift comes amid broader crypto market volatility, though XRP's distinct technical deterioration raises particular concerns for short-term holders. Market participants are closely watching whether key support levels can stem the slide.

XRP Dips Amid Broader Crypto Market Pullback Despite Fed Rate Cut

XRP fell nearly 4.4% in a 24-hour period, mirroring a broader cryptocurrency market decline despite the Federal Reserve's first interest rate cut since December. The downward movement appears disconnected from immediate catalysts, though traders cite excessive leverage unwinding after last week's rally.

Market participants had initially anticipated sustained momentum following the Fed's dovish pivot. However, the central bank's projected 2026 rate path proved less aggressive than expected, creating a 'sell the news' dynamic. Funding rate spikes across crypto derivatives markets suggest speculative positions were overextended.

Regulatory developments offered a counterbalance to the price action. The SEC's revised spot-ETF approval framework could accelerate institutional crypto adoption, though the market impact was overshadowed by technical factors. "This is classic crypto market behavior," noted Kaiko's Adam Morgan McCarthy, referencing the cascading liquidations that followed minor price declines.

Remittix Emerges as Ripple Challenger Amid XRP Market Stability

Ripple's dominance in cross-border payments faces fresh competition from Remittix (RTX), a rising altcoin touted as "XRP 2.0" by market observers. While XRP maintains a $177.98 billion market cap at $2.97 per token, Remittix's $0.1130 entry point and transaction efficiency claims are attracting speculative interest.

The payments sector narrative is bifurcating: established networks like Ripple demonstrate resilience with $3.37 billion daily trading volume, while innovators like Remittix capitalize on demand for next-generation settlement layers. Market dynamics suggest both may thrive—XRP as institutional infrastructure, RTX as a high-growth contender.

Ripple (XRP) Tests Key Support Amid Market Liquidation Event

XRP plunged below $3 during a market-wide sell-off, retesting critical support at $2.7. The cryptocurrency now faces a decisive moment as buyers attempt to stem further losses.

Bearish momentum dominates the charts, with sellers gaining strength after confirming lower lows. Trading volume patterns suggest sustained downward pressure, increasing the likelihood of a breakdown below current support levels.

The daily MACD's bearish crossover signals weakening technical foundations. Should the $2.7 support fail, analysts anticipate a test of $2.5 as the next potential floor for XRP's price.

XRP Price Warning: Break Below Key Support Levels Could Signal Further Decline

XRP faces a critical juncture as it hovers NEAR $2.80, with analysts warning that a drop below $2.77 or $2.65 could invalidate its long-term bullish structure. The 50-day EMA converges with price action at $2.77, creating a make-or-break level for the digital asset. "If we break through this target, we could see further downside," cautioned EGRAG Crypto, highlighting the fragility of current support zones.

Market data reveals conflicting signals—76% of traders maintain long positions despite $66 million in outflows. Technical indicators offer cautious optimism: the RSI sits at a neutral 54, while rising EMAs suggest latent upside potential if resistance at $2.94 breaks decisively. Historical patterns show $2.65 as a pivotal level, with failure potentially triggering tests of $2.50 or even $1.85 support.

EGRAG confirms completion of a five-wave corrective pattern, labeling the $2.82 retracement as part of a "Throw Back Process" following rejection at stiff $3.13 resistance. The convergence of 21-day EMA and 33-day SMA at $2.94 now forms the nearest upside target, with traders watching for either confirmation of trend continuation or signs of broader breakdown.

Ripple's XRP Gains Momentum Amid Regulatory Clarity and Adoption Prospects

XRP has surged 45% year-to-date, buoying investor sentiment. The cryptocurrency now faces a pivotal moment as regulatory hurdles diminish and institutional adoption looms.

Ripple's settlement with the SEC—a $125 million resolution—marks a turning point. Legacy financial systems like SWIFT may soon face competition from Ripple's faster, cheaper cross-border payment network. Yet widespread bank adoption remains elusive after years of regulatory uncertainty.

The real breakthrough lies ahead. With legal clouds parting, major financial institutions could finally integrate Ripple's technology at scale. Market participants are watching for the first domino to fall—a tier-1 bank embracing XRP for global settlements.

How High Will XRP Price Go?

Based on current technical and fundamental analysis, XRP's near-term price trajectory appears constrained between key support at $2.7661 and resistance at $3.1647. The convergence of technical indicators and mixed news sentiment suggests consolidation is likely before a decisive move.

| Scenario | Price Target | Probability | Key Triggers |

|---|---|---|---|

| Bullish Breakout | $3.50-$3.80 | 30% | Regulatory clarity, sustained adoption |

| Range Bound | $2.75-$3.20 | 50% | Current technical consolidation |

| Bearish Breakdown | $2.40-$2.70 | 20% | Broader market sell-off |

BTCC financial analyst Olivia suggests, 'While short-term pressure exists, the fundamental improvements in XRP Ledger activity and regulatory developments provide a solid foundation for medium-term growth. Investors should monitor the $2.7661 support level closely.'